SEBI Flags Third Unicorn Investor; Ashneer Grover Says He’s the ‘Victim’

New Delhi, April 17, 2025 — Ashneer Grover’s startup Third Unicorn Pvt Ltd has come under fresh scrutiny following revelations that one of its investors, Anmol Singh Jaggi, is being investigated by the Securities and Exchange Board of India (SEBI) for alleged financial irregularities. Jaggi, who is the promoter of Gensol Engineering Ltd, invested ₹50 lakh into Ashneer Grover’s new venture and is now part of a broader financial probe involving suspicious transactions across connected entities.

Jaggi’s Investment Under SEBI Scanner

According to SEBI’s interim order dated April 15, 2025, Jaggi’s financial dealings are being examined as part of a potential misappropriation of funds and fund diversion scheme. The investigation includes a network of companies with links to Gensol Engineering, raising questions about the origin and trail of various investments.

The order notes that Jaggi acquired 2,000 shares in Third Unicorn for ₹50 lakh and held on to that stake as of March 31, 2024. This transaction has now been flagged as one of several in a pattern of possibly irregular financial behavior, although Ashneer Grover and his startup are not accused of wrongdoing in the SEBI report.

BluSmart and Matrix Also Involved

Ashneer Grover, who co-founded BharatPe before launching Third Unicorn, revealed that he had also invested in BluSmart, another venture linked to Jaggi, with a personal outlay of ₹1.5 crore. In addition, he invested ₹25 lakh in Matrix, another company tied into the same ecosystem.

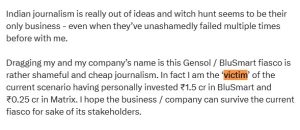

Taking to social media platform X (formerly Twitter) on April 17, Ashneer Grover expressed his position:

“I am the ‘victim’ of the current scenario having personally invested ₹1.5 crore in BluSmart and ₹0.25 cr in Matrix. I hope the business company can survive the current fiasco for sake of its stakeholders.”

Ashneer Grover emphasized that his startup should not be held responsible for the financial history or conduct of its investors.

“A private limited company is not liable for the conduct of shareholder or doing diligence / ascertaining their source of funds,” he added.

No Direct Allegation Against Third Unicorn

So far, Third Unicorn has not been named in any wrongdoing, nor has Ashneer Grover been accused of complicity. The SEBI investigation is currently centered on Jaggi and his network of financial transactions, some of which intersect with companies he either controls or has funded.

However, the situation does raise important concerns about due diligence practices in the startup ecosystem, especially in India’s rapidly evolving tech and fintech landscape. With funding often coming from private sources or informal networks, verifying the integrity and legality of funds remains a challenge.

For More: iPhone Tariffs: How Trump’s Trade War Could Cost You BIG)