Bill Ackman Flexes Control Over Howard Hughes With a Massive Deal

Billionaire investor Bill Ackman has significantly deepened his involvement with Howard Hughes Holdings (HHH), announcing a $900 million deal that will give his hedge fund Pershing Square a 46.9% ownership stake in the real estate firm. The investment, disclosed Monday, is part of Bill Ackman’s ambitious plan to transform Howard Hughes into a diversified conglomerate akin to Warren Buffett’s Berkshire Hathaway.

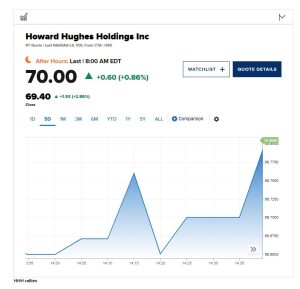

Under the agreement, Pershing Square will purchase 9 million newly issued shares at $100 each—a striking 48% premium over Howard Hughes’ Friday closing price. The market reacted positively, with shares of HHH rising nearly 3% following the announcement.

The move positions Bill Ackman not just as a major shareholder but also a key decision-maker. He will now serve as executive chairman of the board, while Ryan Israel, Pershing Square’s Chief Investment Officer, will become CIO at Howard Hughes. The increased leadership role signals a long-term strategic shift for the company, well beyond real estate.

In a statement, the company emphasized its aim to use the new capital to evolve into a diversified holding firm, while continuing to grow its core master-planned communities and real estate development segments.

Ackman, speaking to CNBC, reiterated his admiration for Buffett and hinted at ambitions to replicate Berkshire Hathaway’s playbook—including possibly acquiring or launching an insurance business under the Howard Hughes umbrella.

Pershing Square will receive a quarterly base fee of $3.75 million, plus a performance-linked management fee tied to changes in Howard Hughes’ market capitalization. The deal also includes provisions limiting Pershing’s voting power, a move likely aimed at easing regulatory scrutiny and protecting minority shareholders.

With this bold step, Bill Ackman is no longer just an activist investor in Howard Hughes—he’s steering the ship.

For More: Harsh Pokharna: IITian Struggles with Bengaluru Rent Despite Raising ₹120 Crore in Funding